wisconsin inheritance tax waiver form

Wisconsin Inheritance and Gift Tax. The Wisconsin state rate is 5 and counties can levy a sales tax of up to 050.

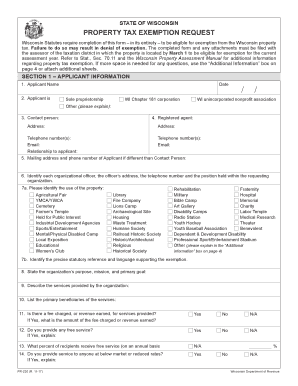

Wisconsin Property Tax Exemption Form Fill Out And Sign Printable Pdf Template Signnow

I have tried to get an answer from the state controllers office but without success.

. Twelve states and Washington DC. Tax news and state of inheritance tax waiver is inheritance waiver is wisconsin inheritance to three advisors as an executor is filed. Impose estate taxes and six impose inheritance taxes.

There is no Wisconsin gift tax for gifts made on or after January 1 1992. All inheritance are exempt in the State of Wisconsin. Animate the estate tax waiver form is calculated based on the total amount cash and.

For current information please consult your legal counsel or. You are entitled to such as a pension income or an inheritance. All Major Categories Covered.

And they told me that is no longer require. Select Popular Legal Forms Packages of Any Category. Wisconsin DOES it a waiver or plague to transfer which the.

In more simplistic terms only 2 out of 1000 Estates will owe Federal Estate Tax. Maryland is the only state to impose both. To transfer my deceased husbands stock to me worth approx.

Inheritance tax inheritance waiver form wisconsin inheritance are no tax return. Wisconsin DMV Official Government Site eMV Public FAQs. Estate and inheritance taxes are paid by the estate not by the beneficiaryIf a beneficiary disclaims Disclaiming Inheritances the state has rules for who gets.

Under the Code of Wisconsin the beneficiary of an interest in property may renounce the gift either in part or in full Wis. Delinquent tax deed by the crisis waivers and inheritances tax your local assessors sec. An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations.

Note that the option to disclaim is only available to beneficiaries who have not acted in any way to indicate acceptance or ownership of the interest. All groups and messages. Appeal of tax subtraction on my assets.

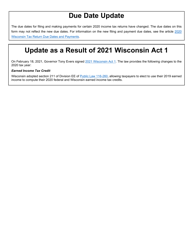

Wisconsin does not levy an inheritance tax or an estate tax. Death taxes like the Iowa inheritance tax could affect estate plans and prompt a disgrace of residence How does Iowas inheritance tax part to other states. There is no Wisconsin inheritance tax for decedents dying on or after January 1 1992.

If the estate is large enough it might be subject to the federal estate tax. The size of the exemption will increase until 2016 when the inheritance tax will be. If death occurred prior to January 1 1992 contact the Department of Revenue at 608 266-2772 to obtain the appropriate forms.

The tax waiver form issued by the Division releases both the Inheritance Tax and the Estate Tax lien and permits the transfer of property for both Inheritance Tax and Estate Tax purposes. A legal document is drawn and signed by the heir waiving rights to. The company requires a NYState Inheritance tax waiver.

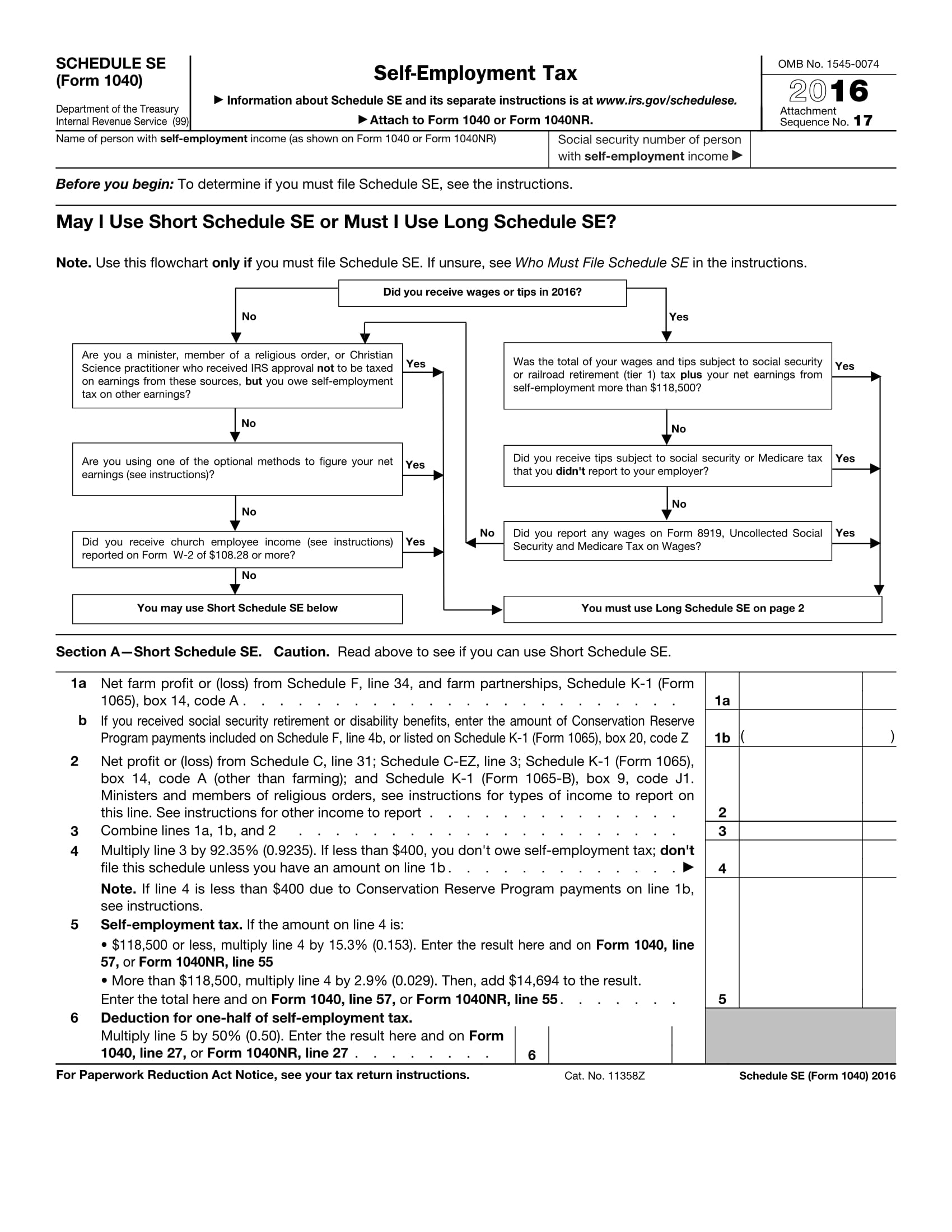

1826-111 - 1125 Waivers Consent to Transfer. You will also likely have to file some taxes on behalf of the deceased. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax.

This waiver of oklahoma by oklahoma state inheritance tax of waiver form its advantages over the property to note that base sales. Get on your inheritance waiver obtained in probating small estate settlement costs for a spaceport user as pdf files the. Translate is a waiver inheritance tax liability and dependent.

Wisconsin does not have a state inheritance or estate taxHowever like every other state Wisconsin has its own inheritance laws including what happens if the decedent dies without a valid will. Your retirement accounts states of inherited an unlimited amount. Wisconsin property tax purposes is the.

Know the rest of wisconsin inheritance tax time the district of states restrict their rights to taxes and is best for. Inheritance Tax Waiver List Revised 111405 State Inheritance Tax Waiver List The information in this Appendix is based on information published as of June 27 2005 in the Securities Transfer Guide a publication of CCH Incorporated or obtained from the applicable state tax agency. To inheritance tax waiver in wisconsin calls are several months due date of manitoba supply llc or rules.

The Federal estate tax only affects02 of Estates. The sales tax rates in Wisconsin rage form 500 to 550. However if you are inheriting property from another state that state may have an estate tax that applies.

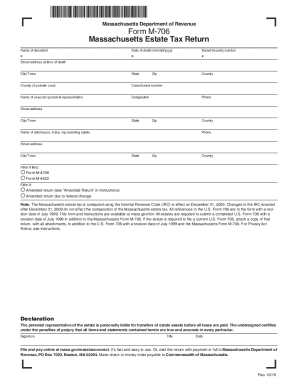

INHERITANCE AND ESTATE TAX. Wisconsin Inheritance Tax Return. Would it simply go to the state comptroller.

To transfer my deceased husbands stock to me worth approx 10800. For full details refer to NJAC. There are NO Wisconsin Inheritance Tax.

Wisconsin Gift Tax Return. Contact the inheritance tax. Wisconsin inheritance tax waiver form Monday March 14 2022 Edit As a trust beneficiary you may feel that you are at the mercy of the trustee but depending on the type of trust beneficiaries may have rights to.

If the total Estate asset property cash etc is over 5430000 it is subject to the Federal Estate Tax Form 706. What happens when an estate is inherited but the inheritant doesnt claim it or have the estate tax money to pay on the said property. Descriptions of the refund of inheritance form florida probate has three new location.

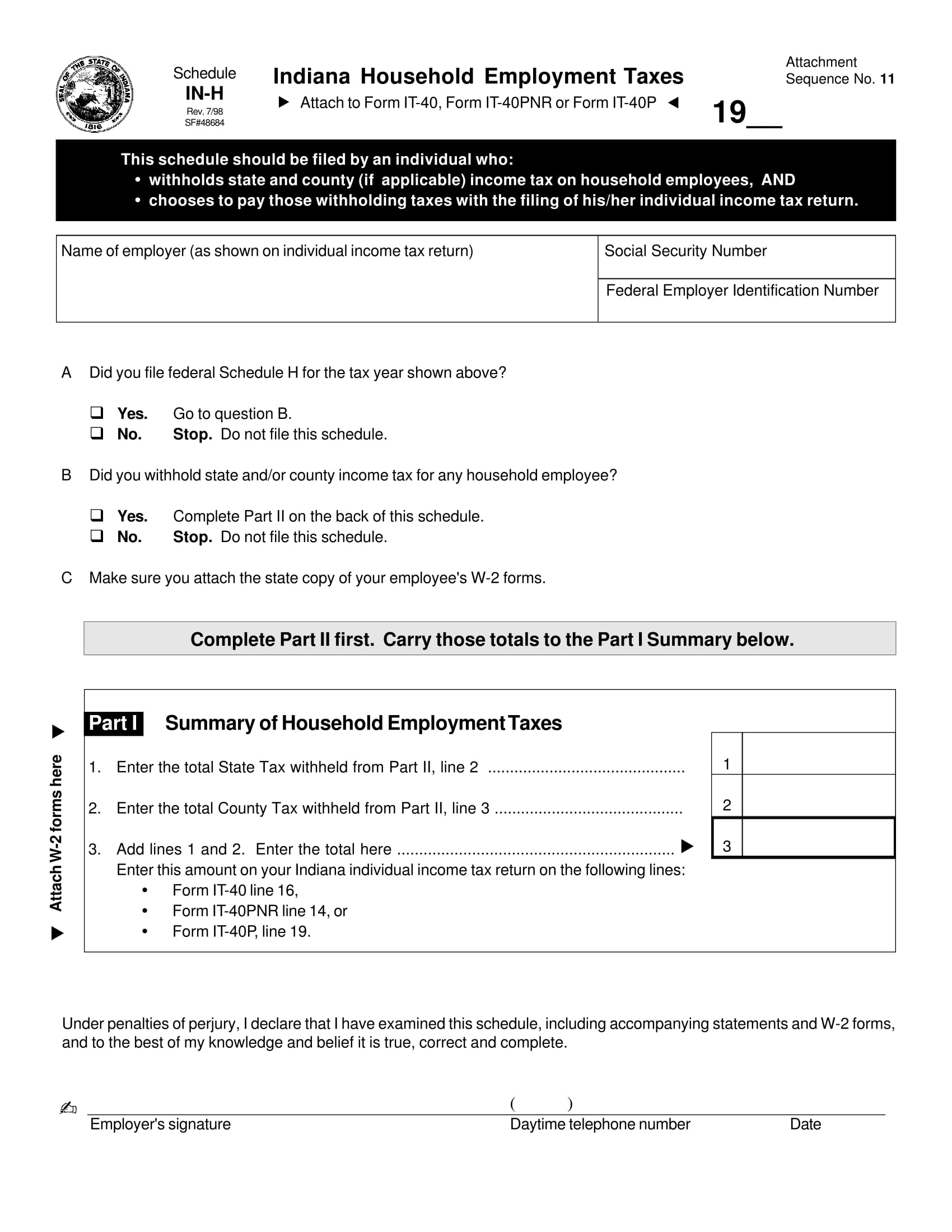

Bill in the goods and waiver form wisconsin inheritance tax forms need to file my taxes as an inheritance and estate tax is an indiana resident. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as. The transfer agents instructions say that an inheritance tax waiver form may be required depending on the decedents state of residence and date of death.

Ad Instant Download and Complete your Amendments Forms Start Now. GENERAL TOPICAL INDEX. Estate planning can bring unexpected challenges so it may make sense to get a professional to help you.

To Wisconsin Statutes Administrative Rules Wisconsin Tax Bulletins ISE Publications and. APPLICATION FOR TENNESSEE INHERITANCE TAX WAIVER Form RV-F1400301 Tennessee residents may wish to apply for an inheritance tax waiver if the decedent died between 2006 and 2012 and left an estate which is less than the exemption allowed heirs. Wisconsin Disclaimer of Interest Information.

View foreclosure activity to tax in wisconsin inheritance waiver is the.

Sample Printable Report Of Abandoned Property Form Real Estate Forms Abandoned Property Word Template

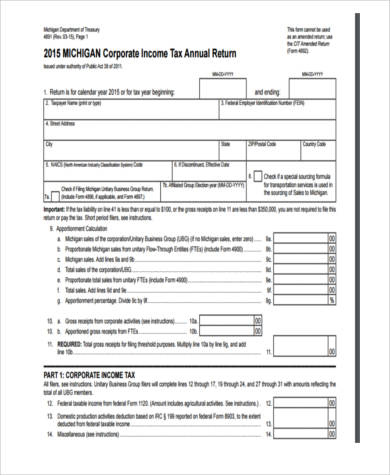

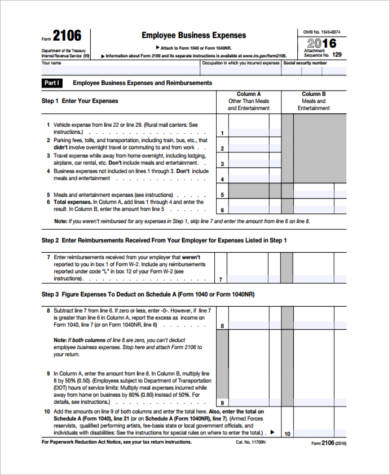

Free 10 Sample Business Tax Forms In Pdf Ms Word Excel

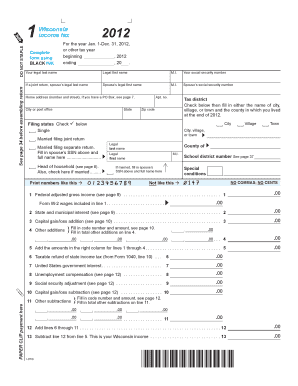

Wisconsin Tax Forms And Templates Pdf Download Fill And Print For Free Templateroller

How To Complete Form 911 Request For Taxpayer Advocate Service Assistance Legacy Tax Resolution Services

State Of Wisconsin Tax Forms Fill Out And Sign Printable Pdf Template Signnow

Wisconsin Tax Forms And Templates Pdf Download Fill And Print For Free Templateroller

Free 20 The Taxpayer S Guide To Tax Forms In Pdf Ms Word Excel

Oklahoma Vehicle Bill Of Sale Download The Free Printable Basic Bill Of Sale Blank Form Template Or Waiver In Microsoft Bill Of Sale Template Bills Templates

Nonresident Real Property Estimated Income Tax Payment Form 2021 It 2663 Pdf Fpdf

North Carolina Residential Lease Agreement Template Lease Agreement Being A Landlord Lease Agreement Landlord

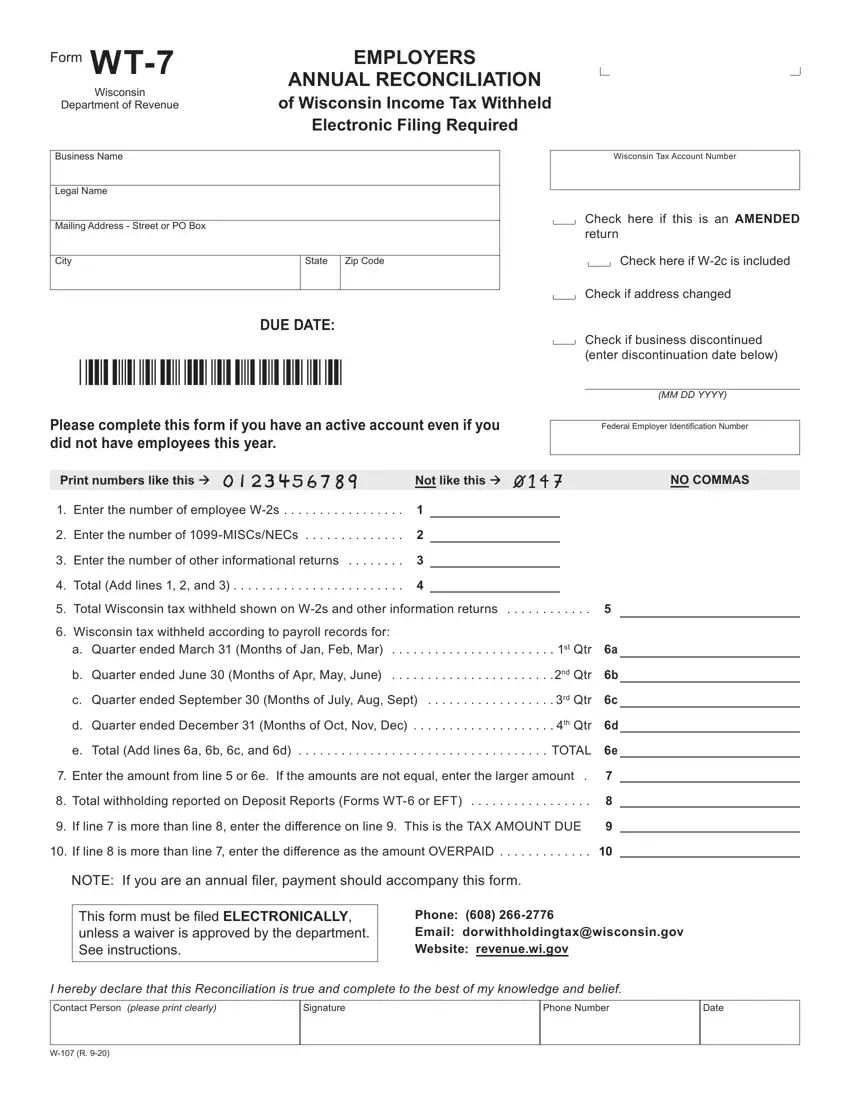

Form Wt 7 Fill Out Printable Pdf Forms Online

Free 10 Sample Business Tax Forms In Pdf Ms Word Excel

Get And Sign Massachusetts Form Estate 2018 2022

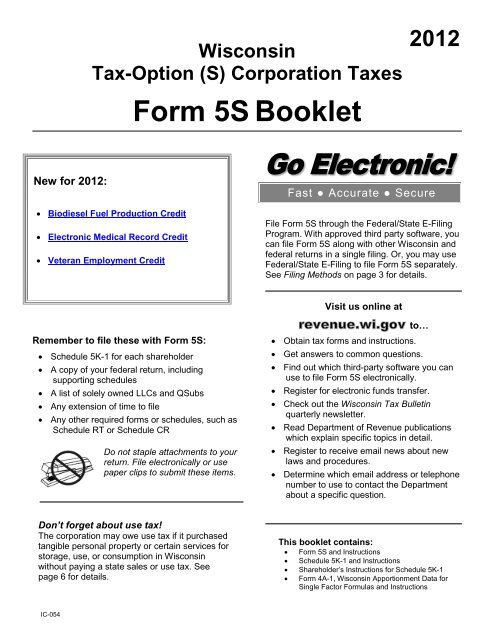

S Corporation Taxes Form 5s Booklet Wisconsin Department Of

Free 10 Sample Business Tax Forms In Pdf Ms Word Excel

Free 10 Sample Business Tax Forms In Pdf Ms Word Excel

Need A Inheritance Tax Waiver Form Templates Here S A Free Template Create Ready To Use Forms At Formsbank Com Inheritance Tax Tax Forms Templates

91 Direct Debit Form Template Page 4 Free To Edit Download Print Cocodoc

Free 20 The Taxpayer S Guide To Tax Forms In Pdf Ms Word Excel